puerto rico tax break

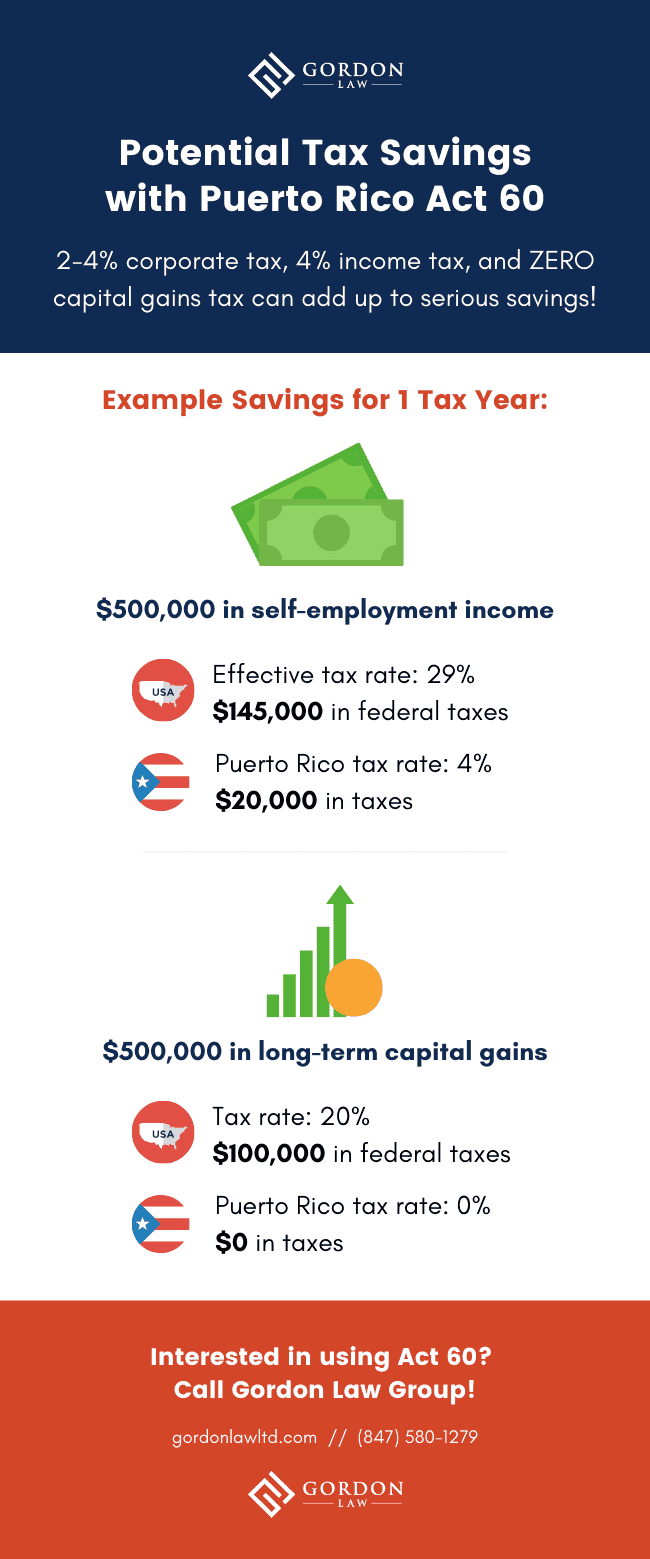

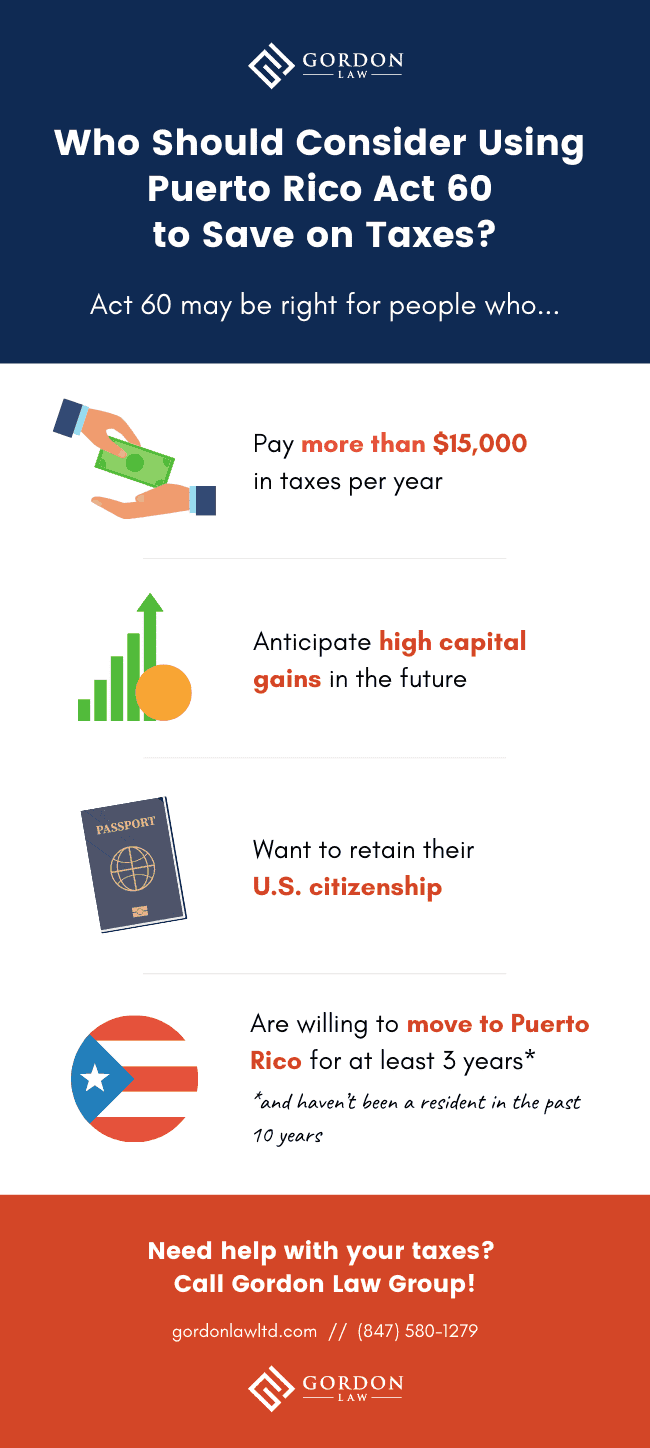

0 capital gain tax for Puerto Rico residents. The one catch is that anyone working at a family office that relocates to Puerto Rico would have to spend at least half the year on the island or they lose the tax break.

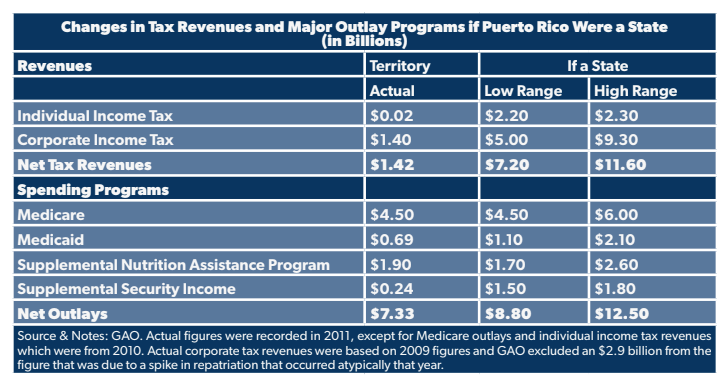

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Lets look at Puerto Rico and take a guess at how long these tax incentives will stick around.

. Act 20 is for companies. Relative to the Made-In-America tax break the Made-in-Puerto Rico tax break has significant advantages. Tax credits of up to 25 of products manufactured in Puerto Rico.

The government says Puerto Rico needs the. Tax credits of 50 of qualified investment. Avoiding what he sees as unnecessarily high taxes in the Golden State in favor of Puerto Ricos considerable tax breaks.

You have to move to Puerto Rico to qualify. Cryptocurrency traders hedge-fund managers and wealthy individuals have been exiting the mainland to Puerto Rico to avoid President Bidens proposed increases on capital-gains tax. Puerto Ricos resident investor incentive commonly known as Act 22 lures wealthy individuals with the promise of legally.

Act 22 Individual Investors Act. Income taxation doesnt apply to amounts you receive for services performed as an employee of the United States or any agency thereof. In 2019 the tax breaks were repackaged to attract finance tech and.

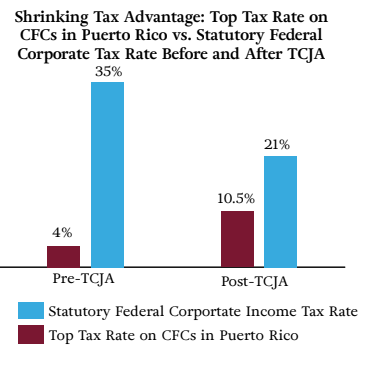

Puerto Rico has a mountain of debt which has tripled in. Super-Rich Headed to Puerto Rico With an Eye on Tax Breaks Jun 8 2021 Blog Because Puerto Rico offers substantial tax advantages a new trend has begun. Still Puerto Rico hopes to lure American mainlanders with an income tax of only 4.

Yet it was Democratic Party leadership in Congress. And 2 the tax rate is for goods and services produced in PR and sold anywhere. Paul is not alone.

The zero tax rate covers both short-term and long-term capital gains. Tax credits for jobs created. Foreign Earned Income Exclusion FEIE allows expats to exclude about 100000 earned income from US federal income tax Foreign Tax Credit FTC gives a dollar for dollar credit for taxes paid in another country.

Act 22 is for individuals. The Made-In-Puerto Rico tax break results in a total corporate tax rate of 4. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse.

If youre a bona fide resident of Puerto Rico youll be able to exclude income from Puerto Rican sources on your US. The special rules in Puerto Rico are simply a matter of Puerto Rican law which can be changed with the stroke of a pen. The key to all this is that Puerto Rican income is exempt from US federal income tax.

Recent press reports confirm Bernie Sanders and Elizabeth Warren are among 34 Democratic Party leaders in Congress opposing tax shelters for the super rich in Puerto Rico. 4 fixed corporate income tax rate. Bitcoin enthusiasts are flocking to Puerto Rico thanks to tax breaks and an island lifestyle.

For decades the US. Act 20 Export Services Act. For years the wealthy have swarmed to Puerto Rico to profit off of tax exemptions that dont extend to native Puerto Ricans and while the island is still in an economic crisis there are concerns that.

If youre a bona fide resident and have to file a US. You have to pay yourself a normal base salary. Private wealth clients hedge fund managers and cryptocurrency traders fleeing to Puerto Rico for its huge tax breaksand to escape President Joe.

A growing number of wealthy outsiders are moving to Puerto Rico to take advantage of the islands tax breaks. Commonwealth had relied on tax incentives as a growth strategy luring industries such as manufacturing and. 1 the 4 corporate tax rate has existed for decades and lasts potentially decades into the future.

0 tax on owner profit distributions dividends. The incentive drew more interest after 2017 when Hurricane Maria decimated the island. For the right business and if set up properly this can lead to significant tax savings.

4 corporate tax rate for Puerto Rico services companies. It confers a 100 tax holiday on passive income and capital gains for 20 years. Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide resident and establishing an office in Puerto Rico will pay just 4 corporation tax and no tax on capital gains dividends interest and royalties.

Congressional Democrats Oppose Tax Breaks for Wealthy in Puerto Rico Congressional Democrats Oppose Tax Breaks for Wealthy in Puerto Rico. Tax benefits for US expats in Puerto Rico. Puerto Ricos turn as a tax haven for the rich began in 2012.

Those two tax acts offer low to no taxes on certain types of income. It gives owners of incented new Puerto Rican companies a 34 tax on dividended income. As the community grows its attracting more newcomers from the states as well as curious locals.

0 or 1 income tax on endeavors categorized as pioneer industries. That didnt matter before because Puerto Rican taxes were just as high as US taxes. Legally avoiding the 37 federal rate and the 133 California or other state rate sounds pretty good.

The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse. HISTORY OF CRISIS. But after the crash of 2008 the Puerto Rican economy never recovered so the government offered these incentives to attract investors and entrepreneurs.

US Americans living abroad can use two unique tax breaks to mitigate expats US tax burden. However this exemption from US. Salvador Casellas a federal judge and former treasury secretary of Puerto Rico was a leader in lobbying for manufacturing tax breaks in the 1970s during a crisis that echoes.

Tax Breaks for Crypto Millionaires Stir Outrage in Puerto Rico. More recently these two acts were updated and combined in a new law called Act 60.

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Should You Be Moving To Puerto Rico To Save Tax Global Expat Advisors

Puerto Rico Luring Buyers With Tax Breaks The New York Times

Faqs Tax Incentives And Moving To Puerto Rico

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Federal Covid 19 Emergency Paid Leave Rules Apply In Puerto Rico But With Unique Tax Aspects Ogletree Deakins

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax